If you require confirmation of a company’s authenticity or wish to gather more details, the convenience of conducting a GST Number Search by Name proves invaluable. This method facilitates effortless access to and validation of a company’s GST information, thereby promoting transparency and fostering trust in all commercial transactions.

What is GSTIN?

A GSTIN is a unique identification number assigned to every taxpayer registered under GST. It consists of 15-digit alpha-numerics based on the business entity’s PAN. Before entering a GSTIN in your GST returns, it is advisable to verify its authenticity. As a consumer, you may also want to ensure the legitimacy of a GSTIN.

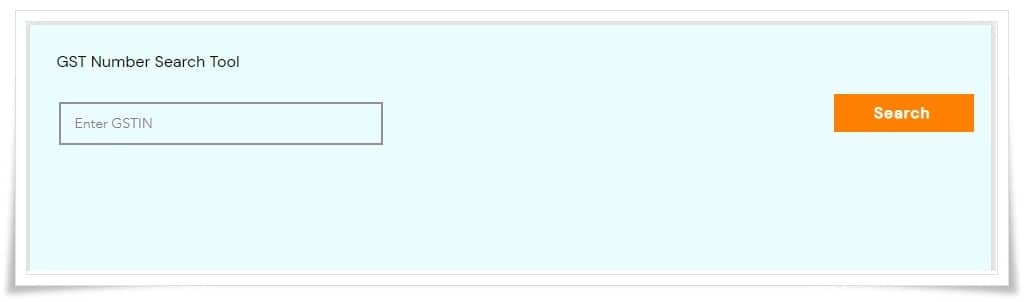

A taxpayer’s GSTIN is public information, allowing anyone to conduct a search to confirm its validity. With the convenience of modern technology, verifying a GSTIN is now just a click away using an instant GST number search tool. It is crucial to verify the GSTIN before engaging in any business transactions.

Utilize the ClearTax GSTIN Number Search by Name tool to easily verify any GSTIN by entering the business name!

Why Is It Necessary to Verify GSTIN or GST Number?

The verification of a taxpayer’s authenticity under GST is crucial, and this is where the GST Number Check feature or Verifying GSTIN comes into play. By ensuring that the Goods and Service Tax taxes are directed to the correct recipients, we can contribute to nation-building and establish a transparent tax system. Additionally, utilizing the Masters India Search Tab for GST Number Search will provide you with the necessary business information to file accurate GST Returns for a specific tax period. Moreover, this search feature will also assist you in claiming the Input Tax Credit (ITC) that may otherwise be lost due to a fake or incorrect GSTIN.

How to Check GST Number?

It is quite common in India to search for GST numbers in order to verify GST details. People typically use either a free GST Number Search Tool or visit the GST portal search. To perform a search, simply enter a valid GSTIN number in the GST Number Search box provided and click on the “Search” button. If the GSTIN is accurate, you will be able to verify various details such as the legal name of the business, principal place of business, additional place of business, state jurisdiction, centre jurisdiction, date of registration, constitution of business (company, sole proprietor, or partnership), type of taxpayer (regular or composition dealer), GSTIN status/UIN status, and date of cancellation (if applicable).

Benefits of Using a GST Number Search Tool

Common Challenges and Solutions

- Businesses and tax professionals can reap numerous advantages from utilizing a GST number search tool. This tool streamlines the process of locating accurate GST numbers, ultimately saving time and minimizing errors. For tax professionals, this translates to enhanced service delivery to clients through swift verification of GST details, a critical aspect in ensuring accurate tax filings. Moreover, having a dependable GST tool at their disposal reduces the time spent on manual searches, enabling businesses to concentrate on their primary operations.

- The utilization of a GST number search tool offers various benefits to businesses and tax professionals. This tool simplifies the task of finding precise GST numbers, resulting in time savings and error reduction. Tax professionals can provide superior services to their clients by promptly verifying GST details, which is essential for accurate tax submissions. Additionally, having access to a reliable GST tool minimizes the time spent on manual searches, allowing businesses to prioritize their core activities.

Frequently asked questions

Is it possible to search for a GST number by PAN?

It is indeed feasible to search for a GST number using the PAN (Permanent Account Number). Every GSTIN is associated with a PAN, thus by inputting the PAN of a business or individual, you can obtain their GST number. This functionality proves especially advantageous for financial and tax-related procedures, guaranteeing that you are engaging with entities that comply with GST regulations.

What is a GST number, and why is it important?

A GST number, commonly referred to as a Goods and Services Tax Identification Number (GSTIN), is a distinctive 15-digit code assigned to companies operating in India. This number plays a significant role in recognizing businesses that are registered under GST, simplifying tax filing and adherence to regulations. It is indispensable for all businesses as it permits lawful trade of goods and services throughout India, while also facilitating access to advantages such as input tax credit.

How can I search for a GST number using a business name?

To locate a GST number by using a business name, individuals can utilize the official GST portal or other online GST number search tools. Simply input the registered business name under GST, and the tool will furnish the GSTIN. This approach is useful for confirming the legitimacy of a business or for tasks related to invoicing.

What are the benefits of using a GST number search tool?

Utilizing a GST number search tool provides numerous advantages:

It assists in validating the legitimacy of a business.

Streamlines business transactions by guaranteeing GST compliance.

Assists in precise tax filing by verifying the GSTIN of suppliers and clients.

Saves time by offering swift access to GSTIN information. These tools are specifically created to enhance the efficiency of GST-related procedures for both businesses and individuals.

What should I do if a GST number search yields no results?

In case a GST number search does not return any results, it may indicate that the details provided are incorrect or the business is not registered under GST. Please verify the information entered and attempt the search again. If the GST number is still not found, consider reaching out to the business directly for their GSTIN or seek guidance from the GST helpline for additional support.

How accurate are the GST number search results?

The precision of GST number search outcomes varies based on the origin. Searches carried out on the official GST portal exhibit high levels of accuracy due to their direct connection to the GST database. While third-party tools may also yield precise results, it is crucial to opt for trustworthy services to guarantee dependability.

What information do I need to perform a GST number search?

In order to conduct a GST number search, you will usually require either the business name or the PAN linked to the business. Certain tools may also necessitate supplementary details such as the state where the business is registered. Accurate information is essential for a fruitful search.

Leave a Reply

You must be logged in to post a comment.