Time and time again, our readers raise various concerns. I explained everything about the Chime Credit Builder card in my last blog post. And also, this time, the question is: how to activate the Chime card online? As I always do, I will answer this most frequently asked question most simply. Since we’re talking about the Chime card activation process, it’s essential to recognize that getting a Chime debit card is free. Likewise, the activation process, established, and the withdrawal of cash in any type of ATM do not generate costs in Chime.

After being delighted with a wide range of benefits, Emma Jones from Florida created a Chime online bank account. You currently use your Chime debit card to make all kinds of settlements. In a brief communication with me, he explained that using a Chime card is relatively easy compared to any other debit card from another bank. He liked the best thing that Chime does not charge weekly, monthly or annual fees. From setting up a debit card and using it completely free on Chime.

So the point is that if you are paying some charge to your bank for using debit card solutions, you are not using the best services. It’s time to consider transforming your financial institution, as well as considering an online Chime bank. So back to our main topic: how can you activate your Chime Visa debit card?

Read More : Tips on Using and Maintaining a Credit Card

Read More : Simple Ways to Earn Free Amazon Gift Cards

How great is the Chime Credit Score Generator Card?

The Chime card is simply a secured bank card. You deposit Chime and get a credit card with a limit equal to the down payment.

A secure bank card is an excellent means of establishing an excellent credit rating for anyone who may not yet be approved for an insecure card. I looked at the Chime website and concluded that it is as good a means of obtaining this type of card as any other.

The card provider reports to all three credit reporting agencies, which is essential. They do not charge any cost, which is also an advantage.

They don’t tell you on the website if they will convert your secured card to an unsecured card and how long it takes to do that conversion.

Sure, I’d be more likely to go to my local credit union or financial institution and get the same type of card if I were trying to build a credit report from scratch. I would go that route as I would certainly have the option of meeting with a natural person as I prepared to take the next important step: eliminating the need for a down payment.

Some establishments will almost certainly convert the card to unprotected after six months of routine use. Others may take a year. Making this change is critical as the size of the security deposit limits your credit. You don’t have that limitation when it’s not safe.

Higher credit limits and low (or no) balances result in a higher credit report. Regardless of where you get your first bank card, you must pay the balance in full each month. Carrying a balance doesn’t help your grades; in fact, it can cost you significant points if the balance reported to the offices is 30% of the limit or even more.

How to activate your Chime card by phone

1-844-244-6363 is the customer service number if you want to start your Chime card by phone call. Follow the instructions that IVR recommends and also press 2 to chat with customer support agents. Initially, you will be asked to validate your identity.

You can contact Chime customer service between 7 am and 7 pm all week except Sunday and between 9 am and 7 pm on Sunday.

Why can’t I use my Chime card?

Have you activated it? Otherwise, call the number on the back of your card to start it. Do you have funds on the card? Otherwise, you will need to transfer funds to your Chime account from your checking account.

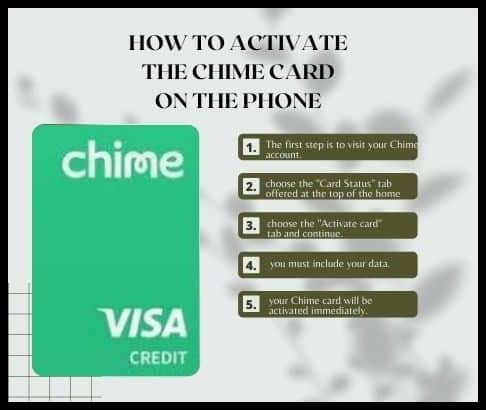

How to activate the Chime card on the phone?

The process to activate a Chime card takes two minutes. All you need to do is use your card details published on your card. This is a quick step-by-step process to activate your card on Chime.

• The first step is to visit your Chime account.

• Next, choose the “Card Status” tab offered at the top of the home screen.

• The next step is to choose the “Activate card” tab and continue.

• Now, follow the detailed guidelines indicated on the screen.

• Be careful when entering your card details, such as card number, CVV number, and expiration dates.

• In addition, you must include your data.

• Follow all the actions correctly, and your Chime card will be activated immediately.

How to use the Chime mobile app

– Install and open the Chime app and finish the login procedure using the email and password.

– When you log in to your account, you will see an alert to activate your card.

– Find the chime card activation web page and enter CVV in the offered area.

After confirming the CVV code, you will get an automatic call to give you the confirmation code.

– Enter the verification code in a featured room to activate the Chime card.

Leave a Reply

You must be logged in to post a comment.