Quick Summary

Bitcoin, the most popular currency in the world, has captured the attention of most of the world due to its profitable gains and greater outcomes. Mining the cryptocurrency is a fundamental process in blockchain technology, as with the mining process, only new Bitcoins are developed and authenticated. Other than Bitcoin, many other Bitcoins are introduced in the market today. The difficulty of Bitcoin mining is also increasing, which has left people perplexed whether the mining is still profitable. New technological advancements are introduced in the marketplace, and many of you must want to know where to buy the best Bitcoin miners. By unveiling each aspect related to Bitcoin mining, we aim to provide you with a complete analysis of it, its difficulty, profitability and future aspect. We will also explore the Bitcoin halving and find out how it is associated with mining. Let’s get to know the information in-depth to comprehensively understand Bitcoin mining by delving into the topic to evaluate the ever-changing blockchain technology industry.

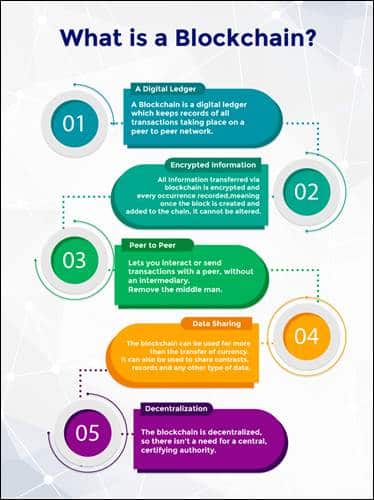

Blockchain Explained

A blockchain is simply an ecosystem of hardware and software that duplicates and distributes a digital ledger of transactions within every single system. A block of data on the chain of ledgers comprises several transactions, and every person involved receives a copy of every fresh transaction on the blockchain network. It is obvious that if anyone tries to execute any kind of manipulation of the data, everyone will be aware that one block in the chain has been altered. It implies that the hackers would need to alter every block in the chain, which requires a lot of time and effort, making it next to impossible. It is what makes blockchain a safer network which is why everyone is intrigued to adopt it, so no security is compromised. Blockchain is helping the world to get more accurate information and provides utmost transparency. It eliminates any malicious act, and only the members involved in a particular blockchain can access information stored on an immutable public ledger.

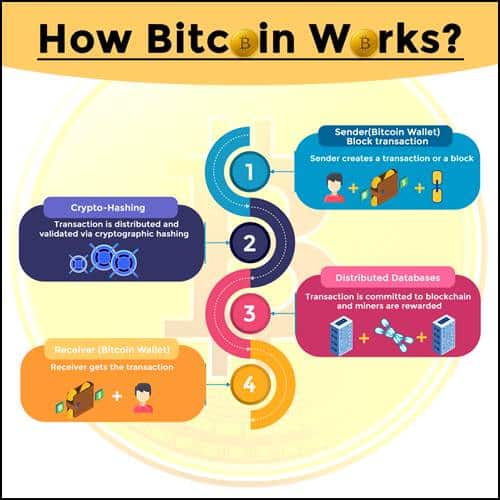

About Bitcoin

Bitcoin is a decentralized digital cash developed using the SHA-256 algorithm. Each financial transaction or activity is recorded on a public ledger accessible to the entire network in concern without any outer body involvement. The value of Bitcoin is increasing each day, making it the most favourable and valuable digital currency. Instead of trusting on a single point of reliance, such as a bank, the nodes( a device connected to the network, keeping encrypted records of all transactions) using encryption are trusted. The main motive behind the development of Bitcoin was to allow people to make transactions worldwide by replacing cash. It offers a different form of payment without any intervention of centralized authority yet functions similarly to conventional currencies by being used for everything a conventional currency is viable for.

Factors Affecting Bitcoin Profitability

The profitability cannot be decided just like that; instead, multiple Factors are taken into account that affects the Bitcoin Miner’s Profitability:

Price of the Miner

The miners used in mining Bitcoins are ASIC miners because they provide better deliverability and higher efficiency. These are widely used for quick efficiency in mining bitcoins but are priced higher.

Electricity Cost

The most vital factor in checking the profitability of a miner is the electricity consumed by a miner to mine Bitcoin. Energy is considered the most common source worldwide, and it is impossible to mine Bitcoin using less energy as it requires what it wants. The good thing is that ASICs are used widely to mine Bitcoins, and newly introduced ASICs are designed to be more energy efficient than any miner. But the electricity is still consumed at some rate which can be considered a little high.

Mining Hardware maintenance

It should be noted that complicated devices must meet certain requirements to function properly; otherwise, they risk malfunctioning. Replacing defective parts can be difficult, and repeatedly purchasing new parts will severely harm profitability. The opportunity cost associated with machine malfunctions, not the repair itself, constitutes the cost of equipment upkeep. Therefore, larger enterprises must also budget for in-house experts to guarantee fast repairs.

Bitcoin Mining Pool

Mining pools were created to balance the predictable costs and unpredictable benefits of individual Bitcoin mining. You must choose the mining pool with a greater hash rate because a miner is only paid when a block is mined successfully. Consider several factors while choosing a Mining pool, such as the mining pool’s reputation, pool size, and profitability. When you choose the mining pool wisely, this might give you better and more efficient outcomes.

What is Bitcoin Mining?

Bitcoin mining is a process of mining new Bitcoins and then sending them to the network concerned for validating these transactions on the blockchain. The blockchain serves as a public record of transactions made with Bitcoin, which is updated through Bitcoin mining. The mining process involves running incredibly powerful computing devices(ASICs) to perform the calculations to authenticate and validate the new blocks of the Bitcoin blockchain. The public ledger containing all the transaction information is updated by the first miner to correctly estimate the number, and they also get rewarded with newly created bitcoins or some amount. You must invest significantly in the best ASIC mining that offers a great cooling system and storage to make money mining Bitcoin. GPU or PC is not capable of delivering profitable results for Bitcoin mining. Hence, purchase the ASIC miners from reliable ASIC miner hardware sellers.

How is Bitcoin Mining Done?

Bitcoin mining follows a proof-of-work consensus protocol because it completely relies on computational devices to maintain a secure network. It takes about 10 minutes to mine a fresh Bitcoin block. Bitcoin mining involves several steps to carry out the process:

Choose your Mining Hardware

You know your requirements and expected outcomes; hence, choose a mining rig that best fits your requirements and expectations. You need to know that powerful mining hardware will work best for Bitcoin mining as it requires much more effort and energy. Hence, only robust mining hardware is suitable for the same. You can get the best mining hardware from the most trusted cryptocurrency mining hardware shop.

Create a Bitcoin Wallet

Creating a Bitcoin wallet that will help you make payments across various platforms, keep your currency safe, and maintain durability is important. You will need this wallet when you authenticate each Bitcoin block. You can create customized Bitcoin wallets based on your needs and security level.

Arrange and Configure your Mining Hardware

Selecting your mining hardware and making a Bitcoin wallet is a key step. You must install and configure your program at this phase. You only need to buy a mining rig, attach it to the power source, a stable internet connection, a USB port, and other requirements to set up a miner. If you have any configuration difficulties, contact customer service via the official website for assistance setting up your miner.

Commence the Mining Process

You can begin mining Bitcoin shortly after you obtain your copy of the blockchain. When you invest in a quality mining rig, your machine does all the labour-intensive work. You must regularly check your mining machine to ensure it operates well and works in your absence. Your mining rig can continuously mine Bitcoin even when you are sleeping or engaged in some other activity.

Types of Bitcoin Mining

Cloud mining

With cloud mining, clients pay somebody else(especially a company) to do the cryptocurrency mining on their behalf, which benefits them. Users only need to pay the mining machine’s rent; the firm in charge handles all other aspects of the operation. The individual and the business that performs the operation split any profits made. The cryptocurrency generated is moved into their crypto wallet. This kind of mining has become very popular since it enables people to profit from mining without performing any process.

CPU mining

The majority of people are now familiar with CPU mining. In this form of mining, computer chips are made, which are further used by computers to create a digital currency. It was the most practical option when Bitcoin wasn’t in the frame. Nowadays, fewer and fewer people choose this option because it is slow, offers a small reward, and miners must pay for additional cooling and power.

GPU mining

The most well-known method for mining digital currency is GPU mining. For miners, it is now the most effective and acceptable option. Graphic cards are used in GPU mining rigs, typically including components like a processor, a motherboard, a cooling system, a power source, a stable Internet connection and graphic cards. It is far quicker and more efficient than CPU or cloud mining.

ASIC mining

ASICs, or application-specific integrated circuits, carry out cryptocurrency mining. Compared to GPU, CPU, or cloud mining, they are recognized to be substantially superior in creating various digital forms of currency.ASICs are employed more frequently for efficient mining because of their strength and capacity to produce effective outcomes. It clarifies that ASIC mining hardware can provide most of the output while GPU mining hardware can only produce a small portion.

FPGA Mining

The field programmable gate array (FPGA) is the miner used to perform a particular task. This kind of mining allows the miner to mine a certain coin as required. The GPU is known to be significantly less efficient than it. It can also be reprogrammed as per the requirement. FPGAs are better than GPUs and CPUs as they deliver better output and are more energy efficient.

Pros and Cons of Bitcoin Mining

| PROS | CONS |

| It can generate great profits if mined the right way. | Fluctuations can increase market risks and volatility, leading to loss. |

| It maintains the security and decentralization of the network. | It requires high energy consumption, contributing highly to the increased carbon consumption. |

| With its demand, more advanced ASIC machines are innovated by companies contributing to technological advancements. | It has become a threat to the personal security of Bitcoin users due to increased malicious activities by Hackers. |

| A best alternate earning source for individuals or firms wanting to diversify their portfolio. | Mining equipment cost and price keep ongoing, which can be expensive to maintain. |

Investment in Bitcoin Mining

Due to the increasing popularity of Bitcoin, people are more inclined towards investing in Bitcoin. Here are a few steps that you can follow to invest in Bitcoin Mining:

Step 1: Joining Bitcoin Exchange

Bitcoin exchanges act in favour of the users to help them exchange trades, services or any other digital assets rather than just making a few transactions. You must know where you will make a purchase using your bitcoins. Many bitcoin users, or most of them, use bitcoin exchanges because it helps to easily trade the bitcoins for the cause they want. There are many exchanges you can join to trade your bitcoins.

Step 2: Get a Bitcoin wallet

A cryptocurrency wallet is a must when you are looking to invest your Bitcoin. It keeps your currency safe, and you can track them in one place. It is more like a normal wallet where you keep all your money arranged so you can use them whenever required. A Bitcoin wallet works the same way, and you can trade or invest a Bitcoin whenever needed by keeping them safe and secured there.

Step 3: Link your Bitcoin wallet to your Bank Account

Once you’re done creating a Bitcoin wallet, all you need to do is link that wallet to your bank account for authentication to easily purchase or sell coins. Also, your bank account must be linked to your Bitcoin exchange account.

Step 4: Place your Order

Once you’re done with all the above steps, the next app is to place an order for your Bitcoin. You will have some cryptocurrency ready with you in exchange for which you can buy everything that you want now to purchase bitcoin, and you might need to spend some coins that would cost you thousands of dollars; hence you must get through all the risk factors involved and make a proper strategic plan before purchasing a Bitcoin.

Step 5: Manage your Investment

After successfully purchasing a bitcoin now, you can make payments true that, or maybe you can hold it up for a longer period that will increase its value and also you can treat it with your coin used for buying or selling them or maybe for cryptocurrency exchanges and just read them wherever you want to.

Follow all the steps, and you’re good to go with investment. Now to know whether investing in Bitcoin is going to be a good step or not. You should know along with the perks come certain risks, so it is important that you are mentally prepared for the risks you can undergo in future, and sometimes things can work in your favour as well. Still, it is always better to remember that some risks would be attached to it, so strategize your plan accordingly.

Return Rewards of Bitcoin Mining

The miners obtain the return rewards in two forms for every new Bitcoin they mine. A coin for mining a new block and some transaction fee from all the transactions included in the block successfully. The miners compete to find the solution to a challenging mathematical problem based on a cryptographic hash algorithm to receive this reward. It is known as the proof-of-work mechanism. The foundation of Bitcoin’s security framework is the competition to solve the proof-of-work algorithm to win rewards. Bitcoin production cost and its value is high at this point. Hence the profitability of Bitcoin is also high.

Understanding Bitcoin Mining Difficulty

Bitcoin’s difficulty measures how hard it is to find a block while mining Bitcoin’s blockchain. Bitcoin’s difficulty adjustment ensures the network stays on track with its predetermined supply schedule. As one difficulty epoch ends, a new one begins with a difficult adjustment to ensure that miners mine new blocks as close to a 10-minute average as possible.

The difficulty of mining Bitcoin refers to how challenging it is to mine a block to add it to the network. The more difficult it is to mine a Bitcoin, the more secure the blockchain becomes. It takes up to 10 minutes for a miner to mine one Bitcoin on average, but it can vary depending on the Bitcoin difficulty encountered by the miner. The difficulty in mining Bitcoin also affects the Hash Price or profitability.

The Formula for finding Bitcoin’s difficulty is as follows:

Difficulty level = Difficulty Target / Current Target

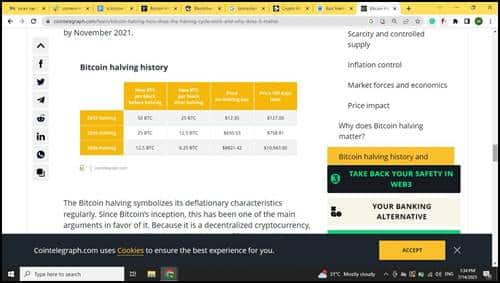

Bitcoin Halving

Once every four years, the mining reward for bitcoins is slashed in half.

A key component of Bitcoin’s economic system is halving. It guarantees a continual stream of fresh coins entering the market. By keeping things scarce, halving combats inflation. As miners compete to contribute new blocks to the network, bitcoin mining resembles an international competition. A specific number of brand-new Bitcoins are awarded to the first miner who completes the block. These block rewards are periodically reduced in half by the way the Bitcoin network operates. It is what the Bitcoin halving means in a nutshell. The Bitcoin halving also impacts the hash rate, making it difficult for attackers to execute fraudulent activities.

Sourced from CoinTelegraph

The image depicts the Bitcoin Halving History that took place three times From 2012 to the present time. The next Bitcoin halving event is expected to occur in April 2024. The price for Bitcoin can be seen to be increased impeccably after each Bitcoin Halving.

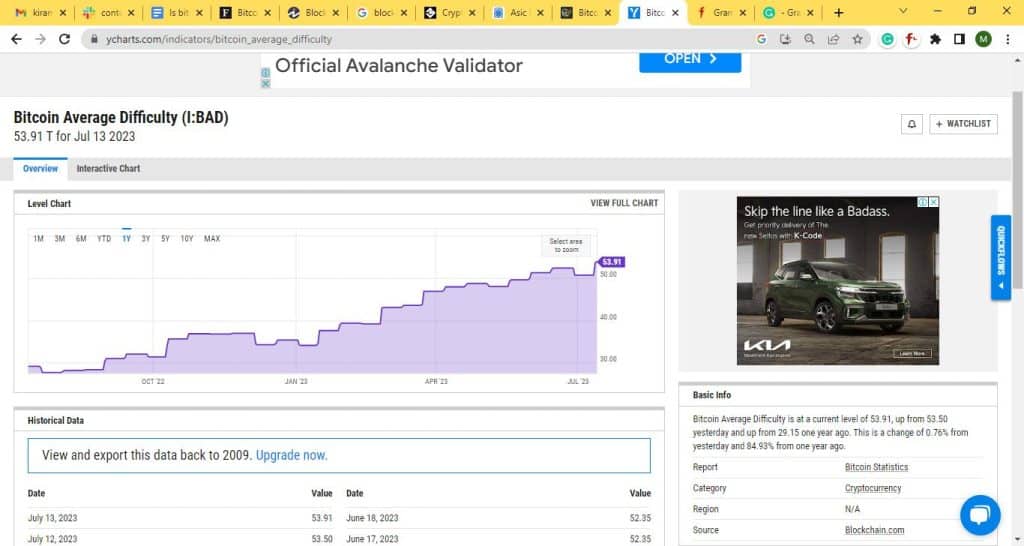

Bitcoin Mining Difficulty in 2023

This year, Bitcoin’s price has been rising faster than the level of difficulty has been rising. Due to the increased value of Bitcoin in 2023 compared to 2022, bitcoin miners have experienced increased profitability. According to the latest information, the Bitcoin network’s block intervals have reportedly been longer than the usual maximum of 10 minutes. Between 10 and 36 seconds, and eleven and 23 seconds have been spent on each block.

As per a latest news article by Bitcoin.com, The Bitcoin network saw two difficult retarget in June. On June 14, there happened to be a 2.18% gain at block height 794,304, while on June 28, there was relatively a 3.26% reduction at block height 796,320.

The difficulty increased on June 14 to an all-time high (ATH) of 52.35 trillion and then decreased just two weeks after to its current level of 50.65 trillion. The difficulty All-time-high was a notable turning point, but on June 11, 2023, at block height 793,868, the total hash power of Bitcoin attained an all-time high of 516.61 EH/s. The next block reward halving is now slightly over 43,000 blocks away, and the next difficulty shift will happen roughly on July 13, 2023.

The Bitcoin difficulty chart below shows that the average Bitcoin difficulty rate is 53.91 as of July 13, 2023. It depicts how much Bitcoin difficulty increased in a year, almost 84.93%, which is a lot.

Future Analysis

It can be seen that the prices of Bitcoin are likely to surge in upcoming years, Keeping in mind the current scenario. The Bitcoin Halving adds up to the rise in Bitcoin prices, and the upcoming event is also expected to add to numerous hikes in the prices of Bitcoin. The year 2023 seems to be a good year for Bitcoin users so far. As per the latest article released by Forbes advisors on July 06, 2023, the bitcoin prices can be seen to experience a hike of $10,00000 by 2025. According to a crypto company’s CEO, bitcoin’s price will likely hit $1M in the succeeding five years.

However, it is important to note that these are predictions, and the market is always risky; hence, nothing is fixed here. If it is claimed to be an impeccable surge, also be prepared to experience some drop in the prices as the market is never constant, affected by the outside factor, the prices can also experience havoc fluctuations.

Summing Up

Bitcoin mining is expected to become profitable for users in the upcoming years. Hence, investing in Bitcoin mining can deliver good results, but it is important to be prepared if the results do not turn out to be exactly how you expected. After reading the above blog, you will be clear that if there are highs, there are lows involved because market risks and fluctuations are unending and unpredictable. Hence, investing can be a great experience, but be prepared for everything as we walk you through every possibility in this blog, from benefits and pros to cons and losses.

Leave a Reply

You must be logged in to post a comment.